Deciding to close a credit card is rarely as simple as cutting it up and moving on. When that card is issued by Chase, one of the largest and most influential card issuers in the United States, the decision carries additional weight. For cardholders in the USA, UK, Singapore, and beyond, the implications extend beyond your wallet to your credit health and future financial flexibility.

While reasons like high fees, unsatisfactory rewards, or a desire to simplify finances are valid, the act of closure can have unintended, lasting consequences. In this guide we will know about “How to cancel Chase Credit Card” in few easy steps.

Why Your Decision Matters More Now Than Ever

In today’s economic climate, characterized by higher interest rates and more cautious lending, maintaining a strong credit profile is paramount. Your credit score isn’t just a number it’s a key that unlocks favorable rates on mortgages, auto loans, and even influences insurance premiums.

Furthermore, Chase’s internal policies, like the well-known 5/24 rule, mean that burning bridges with a closure could limit your access to top-tier rewards cards later. This isn’t about one card—it’s about your long-term financial toolkit.

The Pre-Cancellation Checklist: 4 Essential Steps

Do not call the number on the back of your card until you have completed these four steps. If you skip them, you risk losing hundreds of dollars in value.

| Action Item | Why It Matters | Expert Insight |

|---|---|---|

| Drain Your Points | Rewards usually vanish the moment an account is closed. | Transfer Ultimate Rewards to another Chase card or a partner like Hyatt or United before you pull the trigger. |

| Check the 30-Day Rule | Annual fee refunds are time-sensitive. | Chase typically refunds the annual fee only if you cancel within 30 days of it posting to your statement. |

| Audit Auto-Pays | Missed payments lead to late fees. | Check your “Recurring Transactions” tab. Moving your Netflix or utility bill to a new card takes 5 minutes; fixing a late payment on your credit report takes years. |

| Calculate Utilization | Losing a credit line raises your utilization ratio. | If you close a card with a $10,000 limit, your remaining balances will represent a higher percentage of your available credit, potentially dropping your score. |

How to Cancel a Chase Credit Card?

If you’ve weighed the risks and are ready to move forward, Chase Credit Card offers three primary methods to close an account.

1. The Direct Call: (800) 432-3117

Call 1-800-432-3117 or the number on the back of your card.

Expert Tip: When you speak to the representative, be firm but polite. Often, Chase may offer a retention bonus (like statement credits or extra points) to keep you as a customer. If the offer outweighs the annual fee, it might be worth staying.

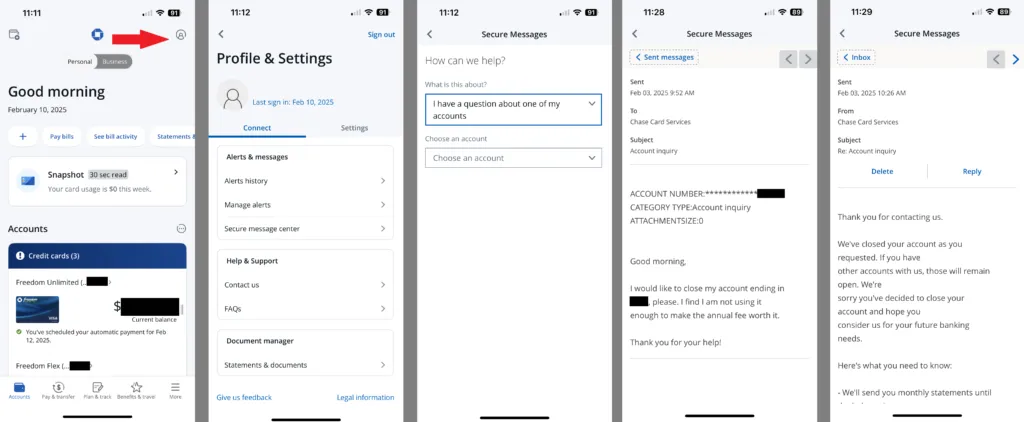

2. The Secure Message Center (Online)

If you prefer not to haggle on the phone, log into your account at Chase.com.

- Go to the “Secure Messages” menu.

- Select “New Message” and choose “I have a question about one of my accounts.”

- Clearly state that you wish to close the specific account number. This creates a timestamped record of your request.

| Official Site | Official Link |

|---|---|

| Chase.com | Official Site Link |

3. Written Request by Mail

Chase Card Services, P.O. Box 15298, Wilmington, DE 19850-5298

Always use certified mail for a delivery receipt.

The Hidden Risks: The “5/24” Rule and Credit History

Closing an account isn’t just about the present; it’s about your future ability to borrow.

The “Average Age of Accounts” Factor Your credit history length accounts for 15% of your FICO score. If the Chase card you are closing is one of your oldest accounts, your “average age” will drop significantly. Even though closed accounts in good standing stay on your report for 10 years, the loss of that open credit limit affects you immediately.

The Infamous 5/24 Rule Chase has an unofficial but strictly enforced policy known as the 5/24 rule. If you have opened five or more credit cards (from any bank) in the last 24 months, you will likely be denied for any new Chase card. If you cancel chase credit card now and decide you want a new one in six months, you might find yourself locked out of the Chase ecosystem because you’ve hit this limit.

Is There a Better Way? Consider a “Product Change”

Before you say goodbye forever, ask about a Product Change. This is the secret weapon of savvy finance enthusiasts. Instead of canceling, you can often “downgrade” a premium card (like the Chase Sapphire Reserve) to a no-annual-fee version (like the Chase Freedom Unlimited).

- Benefit 1: You keep your credit line, protecting your utilization ratio.

- Benefit 2: You keep your account age, protecting your credit history.

- Benefit 3: You eliminate the annual fee without the credit score “hit.”

Final Verdict: A Calculated Decision

Closing a Chase credit card is not a simple administrative action — it is a financial decision with ripple effects across credit scoring, reward ownership, and future banking relationships. The best choice depends on your current credit health, upcoming borrowing plans, and comfort with managing open accounts.

For many cardholders, strategic product changes or fee adjustments achieve the desired outcome with fewer consequences. For others, closure remains the right call — as long as it’s done with full awareness of the tradeoffs.

In personal finance, informed decisions outperform impulsive ones every time.

For more such updates and latest news on Credit Card and Insurance stay connected to moneyinsightpro.com

Thank you ..

Common Questions Answered

No. You must pay the balance in full before closing the account. You can, however, request to close the account to new charges while you pay down the existing balance.

If you close an account with a balance, yes, interest will continue to accrue according to your card’s terms until that balance is paid to zero.

Reopening is not guaranteed and is typically only possible within a short, undefined window after closure (often 30-90 days). You must call customer service immediately. After that period, the account number is usually retired permanently, and you would need to reapply as a new applicant.